Gold has been a symbol of wealth and value for over 2,500 years, first emerging as a form of currency around 500 BCE. Throughout history, its role has shifted—from a standard for economic value to a safe haven against risk and inflation. Despite these changes, gold has remained a reliable store of value, proving resilient in times of economic uncertainty.

As an enduring indicator of global economic health, gold continues to provide insight into fiscal growth and shifts in the market. Today, we’ll take a closer look at the history of gold and gold prices over the past 50 years, helping you understand where the precious metal might be headed and why right now is an ideal time to sell.

Don’t wait—the time is now!

Take advantage of the current value of gold and visit one of our Gold Guys Minnesota locations in Bloomington, Duluth, Maple Grove, and Woodbury!

Can’t get to one of our four Gold Guys locations? Use our hassle-free mail-in service today!

How has the price of gold changed over the past 50 years?

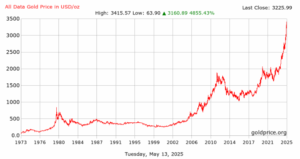

To gain insight into the history of gold prices and understand how the price of gold has evolved over time, let’s narrow our focus to the past five decades exclusively. While the history of gold spans thousands of years, examining the price of gold over the past 50 years provides a more concentrated and pertinent perspective on how gold influences the modern financial landscape and shapes global economic trends.

2025 Updated 50-Year Gold Chart

1970s: The End of the Gold Standard

The 1970s marked a significant shift in the relationship between gold and the global financial system. Here’s what happened:

- 1971: Nixon Severs the Link: In a pivotal move, President Nixon directed the Federal Reserve to stop honoring the direct exchange of dollars for gold. This essentially ended the gold standard system that had been in place for decades.

- Foreign Banks Lose Access: As a consequence, foreign central banks could no longer directly convert their U.S. dollars into gold. This marked the final step in the U.S. dollar transitioning away from a gold-backed currency.

- Stagflation Woes: The stated goal of this move was to combat stagflation, a perplexing economic situation featuring both inflation (rising prices) and recession (economic slowdown) at the same time. However, some argue that inflation itself was partially caused by the rising value of the dollar.

The Detached Dollar and Rising Gold

Interestingly, even though the dollar was no longer directly tied to gold, the price of gold began to climb in the following years. By 1976, just five years after the severing of the gold standard link, the price of gold had skyrocketed to over $120 per ounce.

Price of Gold in the 1980s and the Rise of Gold as a Hedge

The 1980s marked a turning point for gold prices and its role in investor portfolios. What caused the price of gold to go up in 1980?

- Fed Fights Inflation: To combat high inflation, the Federal Reserve implemented aggressive interest rate hikes. This move successfully brought down gold prices from record highs above $800 per ounce.

- Double-Edged Sword: While taming inflation, the Fed’s actions also triggered a recession, causing gold prices to drop to around $400 per ounce by the end of the decade.

- A Pattern Emerges: This period established a crucial pattern: gold’s tendency to act as a hedge against economic uncertainty. Investors began to see gold as a valuable asset during times of financial turmoil.

The 1990s: A Period of Relative Calm

- Golden Stability: Throughout the 1990s, gold prices remained relatively stable, hovering around $300 per ounce. This period offered a time of relative calm in the gold market trends compared to the volatility of the previous decade.

- A Bridge to the Future: Despite the stability, the 1990s served as a bridge between the newfound appreciation for gold as a safe haven and the dramatic events of the 21st century.

- Enduring Appeal: Geopolitical tensions and occasional economic jitters during the 1990s offered glimpses of gold’s enduring appeal as a safe-haven asset. The stage was thus set for gold’s return as a prominent player in the global financial landscape.

This period of relative calm paved the way for the significant price surges witnessed in the following decades due to major global events.

2000s to 2025: A Golden Rollercoaster Ride

The new millennium ushered in a period of significant price fluctuations for gold. The horrific events of 9/11 triggered a nine-year bull run, with prices steadily climbing each year until 2013. This period witnessed a peak of over $1,900 per ounce in August 2011.

Following this peak, the price of gold entered a period of correction, settling around $1,000 per ounce for several years. However, the precious metal remained a valuable hedge against economic uncertainty.

Fast forward to 2019, and the global economic landscape began to shift once again. Geopolitical tensions and concerns about slowing economic growth spurred renewed interest in gold. This trend continued dramatically in 2020 as the COVID-19 pandemic unfolded. The unprecedented economic disruption caused by the pandemic sent shockwaves through the financial system, driving investors towards safe-haven assets like gold.

Looking Back from 2025

As of May 2024, the gold market continues to exhibit some volatility. Prices have surpassed the record highs seen in 2011, and they remain significantly higher compared to the pre-2008 period. The long-term trend suggests gold retains its appeal as a valuable asset during times of economic instability.

Here’s a breakdown of some key events that have influenced gold prices since the 2000s:

- 9/11 and the Global Financial Crisis: These events highlighted the role of gold as a safe haven, driving prices upwards.

- Quantitative Easing: The massive stimulus programs implemented by central banks in response to economic downturns have also contributed to a rise in gold prices.

- Geopolitical Tensions: Ongoing international conflicts and political uncertainties continue to influence gold’s value.

- COVID-19 Pandemic: The pandemic’s economic impact led to another significant price increase for gold.

WHAT THE HISTORY OF GOLD PRICES MEANS FOR TODAY

- The analysis of gold price movements over the past five decades reveals a consistent trend: gold prices tend to rise during times of economic uncertainty, followed by periods of stability or decrease during periods of economic growth.

- Considering historical patterns, the recent highs observed during the current financial crisis may soon stabilize or decrease as the economy recovers and investor confidence in traditional investments like stocks and bonds returns.

- This suggests that the current moment presents an opportune time to sell your gold assets, taking advantage of the favorable price trends observed over the past few years.

- It’s important to note that while gold is currently highly valued, this upward trend is not guaranteed to continue indefinitely.

- Therefore, 2024 presents an ideal opportunity to sell your gold jewelry, coins, bullion, or any other form of the precious metal you own and convert it into cash.

What factors affect the price of gold? Gold Price Forecasts

Predicting the exact trajectory of gold prices is a complex endeavor. The market is influenced by a multitude of factors, making long-term forecasts inherently uncertain. However, by analyzing historical market trends and staying informed about current economic and geopolitical events, we can make educated guesses about gold’s future performance.

Should I Invest in Gold Bullion or Gold Stocks?

Both gold bullion and gold stocks offer exposure to the gold market, but they come with distinct advantages and disadvantages. Here’s a breakdown to help you decide which option aligns better with your precious metals and overall investment goals:

Investing in Gold Bullion (Physical Gold)

Pros:

-

- Tangible Asset: You directly own physical gold, offering a sense of security and independence from the stock market.

- Hedge Against Inflation: Gold prices often rise during periods of inflation, potentially preserving the value of your investment.

- Crisis Resilience: Gold can be a valuable asset during economic turmoil as its price may remain stable or even increase when traditional stocks decline.

Cons:

-

- Storage Costs: You may incur storage fees for keeping your gold in a safe deposit box or secure facility.

- Insurance: Insuring your gold adds an extra expense.

- Liquidity: Selling physical gold can take time and may involve finding a reputable buyer.

Investing in Gold Stocks

Pros:

-

- Potentially Higher Returns: Gold mining companies can amplify gains when gold prices rise, offering the potential for higher returns compared to bullion.

- Diversification: Gold stocks can add diversification to your investment portfolio, reducing overall risk.

- Easier to Buy and Sell: You can easily buy and sell gold stocks through brokerage platforms like any other stock.

Cons:

-

- Stock Market Dependence: The value of your gold stocks is directly tied to the performance of the stock market and the specific mining company.

- Company Risk: The success of your investment depends on the financial health and performance of the individual gold mining companies.

- Less Tangible: You don’t own physical gold, but rather shares in a company that mines gold.

The Right Choice for You

The optimal choice depends on your risk tolerance, investment goals, and overall portfolio strategy.

- For those seeking a safe haven and a hedge against inflation, physical gold bullion might be a better fit.

- Investors looking for potentially higher returns and easier management may prefer gold stocks.

GET MORE FOR YOUR GOLD WITH GOLD GUYS

Gold Guys specialize in helping you get a great price for your gold, silver, platinum, and other precious metals, working closely with you to ensure you’re in full control of the process from start to finish. We’re proud to have received an A+ rating from the Better Business Bureau, speaking to the dedication and level of service we provide to each and every customer.

Visit one of our locations or request your mail-in kit today to receive a free, no-obligation offer for your precious metals and diamonds.