Human civilization’s storied relationship with gold dates back millennia, from serving as the universal symbol for wealth in ancient times to backing the American dollar up until 1971. In more recent decades, gold’s standing within the global economy has become a bit more obscure as the stock market has grown to dominate how we view modern investing.

Despite this shift toward stocks and bonds, gold is still a highly valuable and important asset that has its place alongside more contemporary means of wealth. Here’s a bit of background on how gold and the stock market interact with one another and why gold is still a worthwhile investment instrument in 2020 and beyond.

Equity vs. Commodity

Both gold and stocks are forms of investment, but the way they’re referred to and the way the behave are fairly different.

Stocks are classified as equities, meaning the stockholder owns a portion of the issuing company (as in shares of Google or Amazon). In this scenario, the stockholder profits when the company profits and the price of its stock rises.

Gold, on the other hand, is classified as a commodity, meaning the owner possesses a physical product that can be held in the palm of your hand. In the case of gold and other precious metals like silver or platinum, the owner profits when the demand for that commodity increases and causes its price to do the same.

Because of this, returns from gold are based solely on price appreciation. It has no fungible value unless sold for money.

Ways to invest in gold include:

- Exchange-traded funds (ETFs)

- Buying stock in gold miners or similar companies

- Buying physical gold (like coins, jewelry, bullion, bars, and so on)

Market volatility

Whether you’re dealing with stocks or gold, you should be mindful of price changes and outlooks in order to maximize your return. In general, the stock market is much more volatile in the short term than is the price of gold. Stocks also tend to outperform gold in the long term while gold performs better in the short term.

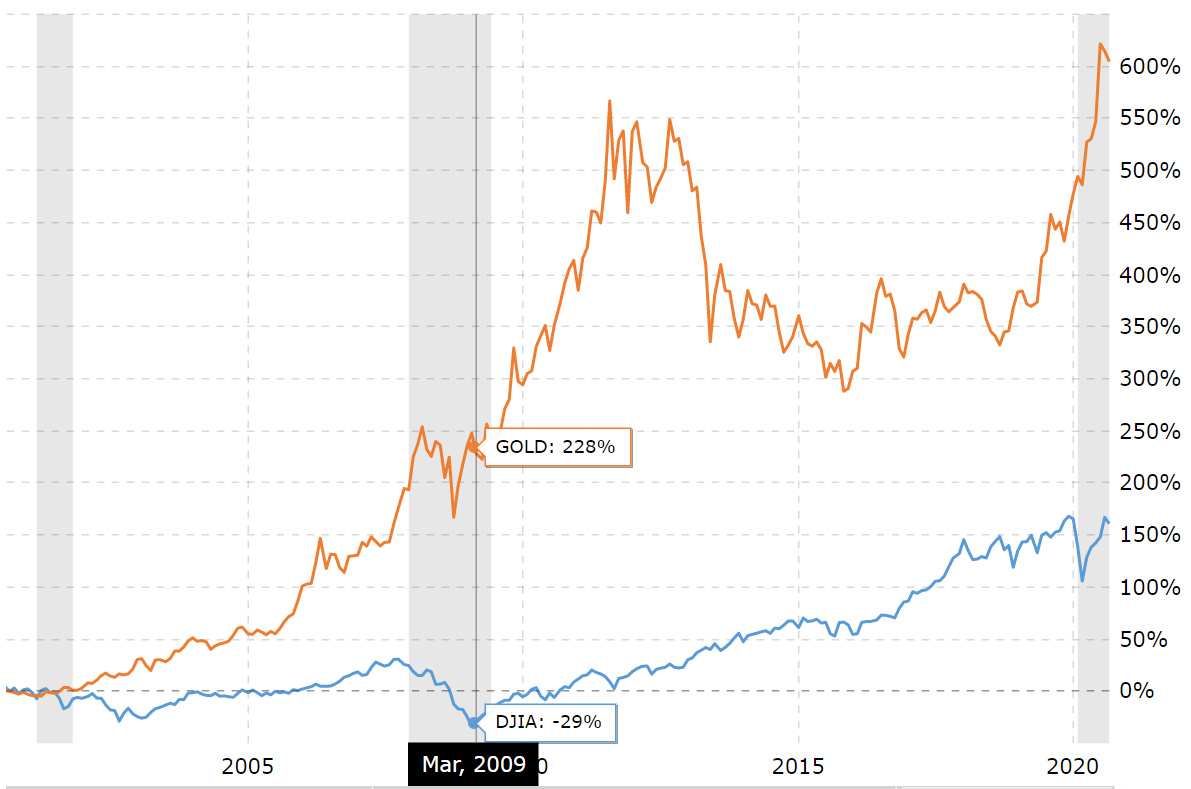

The chart below compares the historical percentage return for the Dow Jones Industrial Average (DJIA) against the return for gold prices over the last 20 years.

As you can see, gold returns have outperformed those of the DJIA over the past 20 years as we’ve navigated multiple financial crises. Still, gold tends to work best as part of a diversified portfolio that also includes stocks and bonds. Because gold’s movement is not correlated to that of stocks or bonds, it can provide stability in times of increased volatility.

Gold as a “safe haven” investment

While stocks are capable of performing as profit-seeking investments, gold has most often served as a safe haven hedge against inflation for investors in times of economic uncertainty (like the 2008 financial crisis and the 2016 Brexit vote). The reason gold is able to provide this stability is because its price has been on the rise for some time while the value of the dollar continues to drop as a result of inflation.

We’re seeing a similar trend this year in the wake of the COVID-19 pandemic, as investors flock to gold as a lesser volatile vehicle. The timing is perfect, as the gold price in 2020 is higher than it has been in years, making it the perfect time to capitalize on the precious metals in your possession.

Sell your gold for more profit with Gold Guys

Gold Guys is proud to honor our statement that we pay the most for your gold and other precious metals. In fact, if you receive a reasonable quote from elsewhere for more money, we’ll beat it – every time. We make sure you maximize your profit in selling gold and that the process is easy and painless.

With Gold Guys – the number-one-ranked mail-in service in the U.S. – you’re in control of the transaction from start to finish at no cost to you.

Here’s how selling gold online for free with Gold Guys works in five easy steps:

- Fill out the form to request a mail-in kit

- Receive your mail-in kit from us in 3-5 business days

- Package your items

- Mail your prepaid, insured package through UPS to our location

- Receive your offer over the phone

If you’re not 100% satisfied with your offer, we’ll return your items completely free of charge. But honestly, we’re confident you’ll be satisfied.

Contact us today to learn more about selling gold and other precious metals.